The earnings period for a director is an annual one and National insurance contributions are normally calculated by reference to earnings paid only in that particular earnings period. National Insurance on director’s salary is paid over to HMRC by the company like other employees (as part of the PAYE Process).

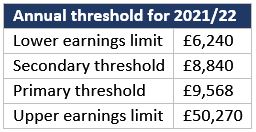

Directors pay National Insurance on annual income from salary and bonuses over £9,568 contributions are then payable at 12% on all earnings until earnings for the year-to-date reach £50,270, with contributions payable at 2% on any further earnings.

It should be noted that the Annual Earnings Period also applies when calculating secondary contributions paid by the employer, with nothing being paid until the earnings for the year reach £8,840, and thereafter at a rate of 13.8%.

It is also noteworthy to mention that the director can opt to pay their contributions on a non-cumulative arrangement if preferred so.

Click this link for more details National Insurance for company directors.